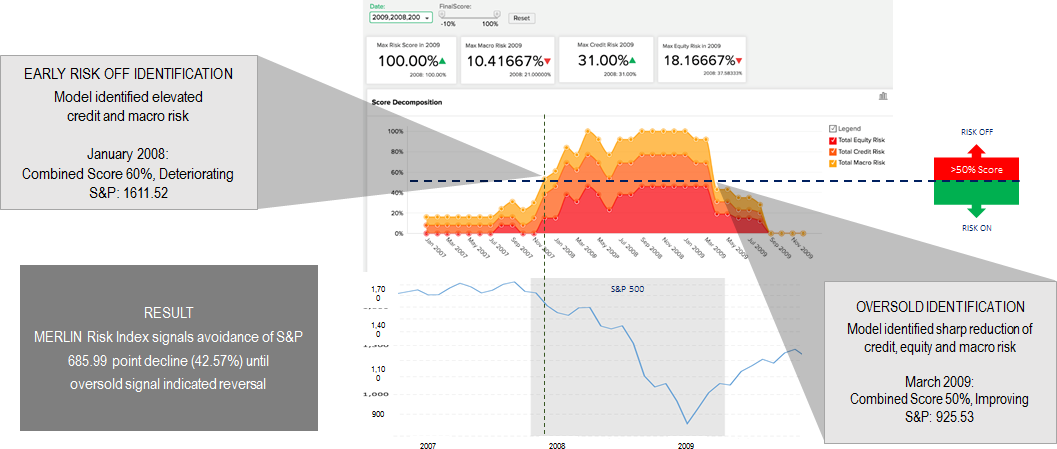

Macro Economic Risk of Loss INdicator M.E.R.L.I.N

Combining Equity, Macro and Credit Risk Factor Models to Determine a View of Market Risk

To inquire about free access to the MERLIN dashboard, click below.

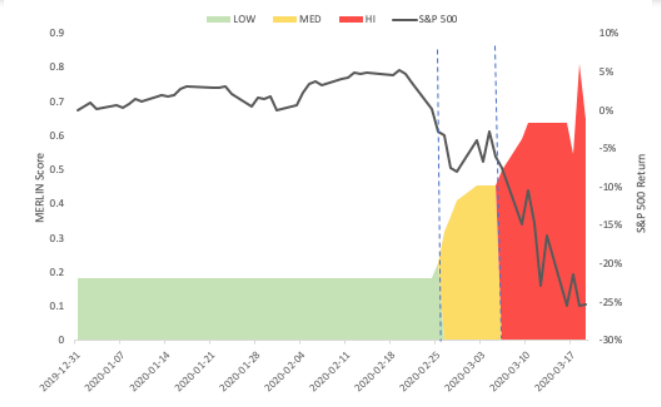

Q1 2020 Update:

How Did Our Tail Risk Indicator do? In the face of an unprecedented global selloff in risk assets, MERLIN did an excellent job of signalling a true “tail risk” event by the end of February. Read the full article to see how it’s performed in other historical drawdowns.

Our Philosophy

Life is about modeling expected outcomes…

Financial markets are no different. Just as the natural world provides clues about the underlying order of things, so too do the markets and the economy. While it has been said that modern-day humans are drowning in data but starved for information, with M.E.R.L.IN, we distill that data into actionable insights about future states of the world.

M.E.R.L.IN Tail-Risk Score

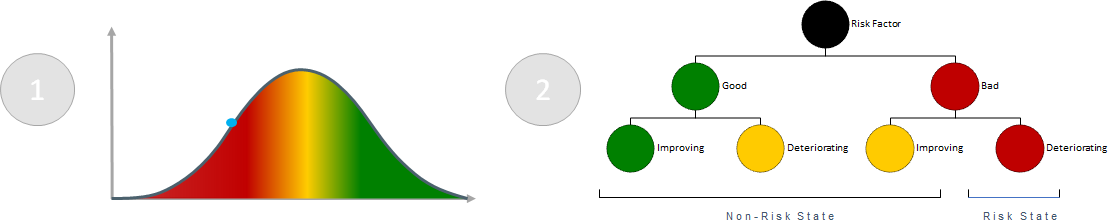

The IDX MERLIN Tail-Risk Model dynamically weights various equity, credit and macro variables to determine current levels and directional trends of each portfolio risk factor.

Each variable is (1) evaluated relative to its historical distribution, and (2) whether it’s improving or deteriorating. This determines whether each variable is signaling a “Risk” state or a “Non-Risk” state.

IDENTIFYING TURNING POINTS

The result is an easy to interpret indicator, that’s updated daily and offers full transparency into the underlying risk-drivers.