Updated: July, 2022

The Original Index

The original stock market index was published by Charles Dow in his “Customer’s Afternoon Letter” in 1884. The index was comprised of just 11 companies of which 9 were railroads. The idea behind this index was to provide a useful and objective barometer for the U.S. economy at the time. Dow’s next index, the Dow Jones Industrial Average launched in 1896 and continues to be published in the successor to the “Customer’s Afternoon Letter” (called The Wall Street Journal).

The Evolution of Indexes

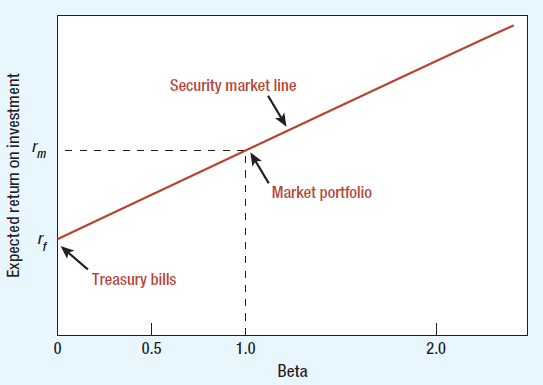

While the original intention of the Dow index was simply to convey a general (and objective) measure of the economy, by the 1960’s the Capital Asset Pricing Model had introduced the idea of a market-cap weighted “market portfolio” as an investable index against which a framework was built to measure active managers’ “alpha”.

A generation later, Fama & French would publish their pioneering research which put forth two other portfolios (and eventually indexes) as “alternatives” to the CAPM “market portfolio”. These alternative betas (size and value) would extend the CAPM framework into the domain of active managers and thus ushered in the very beginning of what would become the Indexing Revolution.

ETFs: the original innovation

When State Street launched the SPDR S&P 500 exchange traded fund (ETF) in 1993 it would mark the beginning one of the most innovative disruptions on Wall St. ETFs offered the ability to trade a diverse basket of stocks, through a single exchange traded vehicle on an intraday basis. While the idea itself was not new (Canada had already launched an ETF at few years prior and the indexing mutual funds had been around for awhile), the SPY ETF was so simple and easy to own. This was a time when the internet was still new and most investors were used to brokerage accounts that required a phone call and had ticket charges of $15. The ability to click a button and be able to own a proportional share of the S&P 500 in a matter of seconds with low dollar amounts and low transaction costs was a big deal for retail investors.

To say it was revolutionary is an understatement. The cheap and easy diversification afforded by ETFs democratized the investing landscape for investors. This ushered in an entirely new era of investing which would, not only reduce costs, but also change the perspective of how many would think about investing. More and more investors would begin to think about investing in exposures and not just individual companies. For these reasons, ETFs were as much a technological innovation as a financial one.

The ETF Revolution and the Rise of Passive

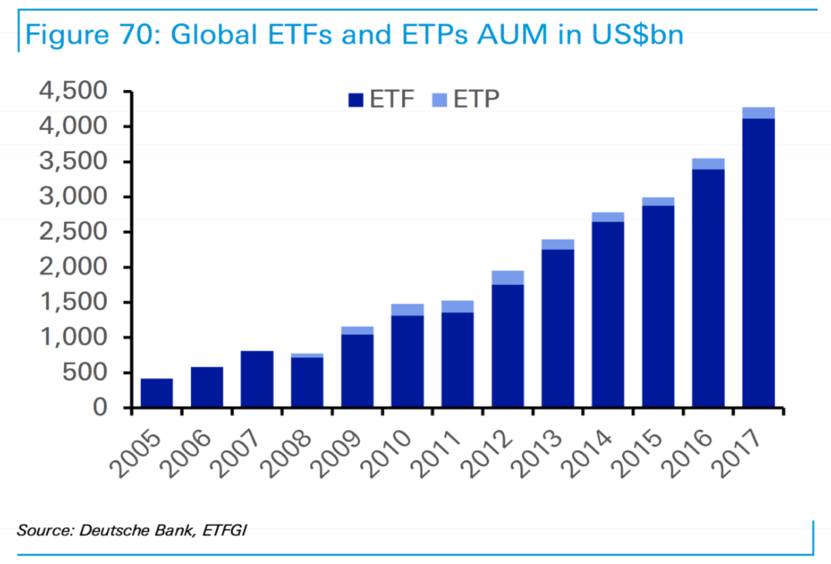

The utility of ETFs was immediately obvious and as investors continued to crave the easy diversification provided by these low-cost, transparent vehicles, Wall St. was eager to fill that demand. This saw a multi-decade period of proliferation as ETF sponsors realized there was demand for almost any kind of ETF. Everything from industry sectors to gold mining companies to the various iterations of “Smart Beta” ETFs had a buyer. The 2008 financial crisis only accelerated this demand as ability of active managers to deliver “alpha” was called into question en masse. Research even showed that active managers actually added negative alpha during the 2008 crisis[1]. Whatever the reason, 2008 proved a powerful catalyst in the growth of ETFs. As can be seen in a recent Deutche Bank report, the growth in ETFs (and ETPs[2]) since 2008 has been nothing short of “extraordinary”:

ETFs: Enabling the Robos

One important outcome of ETFs wasn’t just that they provided investors with an inexpensive and easy way to diversify, but, that they allowed investors to think differently about how they approach the investing problem. If one could now buy exposure to various exposures (“factors”) as easily as they could buy stocks (including intraday liquidity), the opportunity set for portfolio construction expands dramatically.

The idea of investing in various “factors” certainly wasn’t new but, now that the practical limitations of implementing increasingly sophisticated combinations of factors was significantly reduced, it opened up a whole new world. This reality coupled with increasing academic and empirical evidence that active managers couldn’t beat passive fueled the rise of so-called “Robo-Advisors”. Robo Advisors apply systematic, rules-based methodologies to create “passive” portfolios of ETFs. The goal is a low-cost, rules-based portfolio of ETFs that doesn’t suffer from any of the behavioral drags on performance associated with active management.

This should be all good for investors, right? The answer is generally “Yes” (at least when compared to the decades past), however a couple of key issues remain. The first being with the ETFs themselves.

Moving Beyond ETFs

There are now more than 2000 ETFs listed in the US which collectively account for about 30 per cent of all US trading by value, and 23 per cent by share volume. Prudent investors are now asking if this is simply too many.

Quantity over Quality

With the explosion in number of ETFs, one can’t help but ask if this has come at the expense of quality. Do investors really need 2000 ETFs? One has to wonder if the ETF market has become flooded with mediocre products in a business that rewards those products with the broadest appeal and quickest time to market. An increasing number of ETFs have been launched and closed within the same year. Launching an ETF is still a costly endeavor that requires several months to launch and then typically needs $50M to breakeven[1]. This fact, combined with the increasing competition in the space (which is decreasing ETF fees for the sponsors) means ETF sponsors are increasingly incentivized to launch ETFs that can capitalize on “the next new thing” with broad marketing appeal but not necessarily the thoughtful construction investors are relying on. With most of the focus on fees, investors risk losing sight of the importance of construction. At a minimum, investors now need to navigate an increasing number of ETFs (potentially frequently).

Liquidity

Another important concern is around ETF liquidity…and whether or not it’s falling victim to its own success? In an interview with Business Insider, Peter Dixon (Economist with Commerzbank) said: “If everybody is trying to get out at the same time, the question has to be, do ETFs exacerbate or magnify the impact of the decline?”[1].

A recent Bank of America Merrill Lynch report issues a similar warning about the “surge” in ETF popularity creating distortions in the underlying stocks.[2] As more and more investors turn towards ETFs instead of stocks for equity exposure the odds increase that the daily trading volume in the ETFs will actually be greater than their underlyings. A report last year from the Federal Reserve noted “As ETFs may appear to offer greater liquidity than the markets in which they transact, their growth heightens the potential for a forced sale in the underlying markets,”[3].

While this risk is most obvious for ETFs of fixed income products, it can present problems for equity ETFs as well. Particularly as ETFs co-mingle capital from different market participants with different timeframes, sophistication and trading capabilities, the risk of a divergence between an ETF’s “implied” and “actual” liquidity becomes acute.

While this doesn’t necessarily represent an existential threat to ETFs, it does mean that investors need to mindful of these risks and likely more tactical in their use of ETFs (either directly or through a third-party manager).

Tax Benefits of Direct Indexing

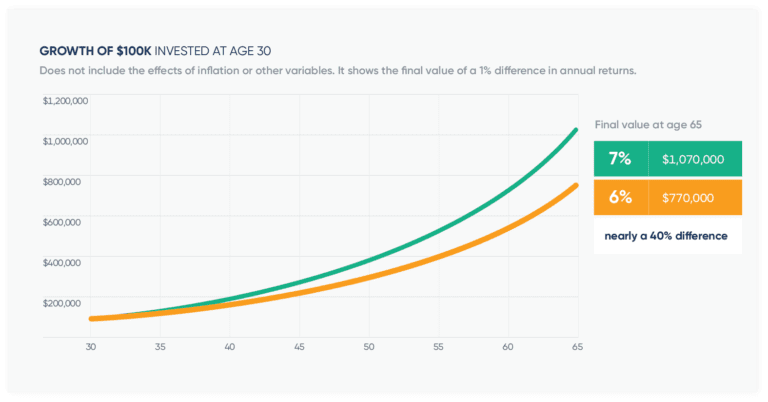

The final issue with ETFs that most investors generally don’t think about is around taxes. ETFs are generally thought to be tax-efficient because, relative to mutual funds, they generally don’t trade as often and therefore typically distribute less in capital gains. While this may be true, it ignores one important limitation of ETFs…the ability to tax loss harvest individual stocks.

Tax loss harvesting takes advantage of diversified portfolios of equities by selling stocks that have declined (therefore generating a tax loss) and using that loss to offset other gains. Because the stocks that have been sold can be replaced with highly correlated substitutes, the investor can theoretically maintain the portfolio’s return profile while “harvesting” the losses therefore creating a higher after-tax return. For taxable portfolios, these savings can add up quickly. Depending on the tax bracket, the benefit can be more than 1% per year.[6]

For these reasons, institutions have largely avoided the ETF structure and owned indexes directly. The size advantage of institutions has allowed them to own the individual stocks of their preferred index. Technology has no made that possible for investors of almost any size.

Direct Indexing: The Next (R)Evolution

As is the case with any industry, Finance has evolved from technological improvements over the decades. Direct Indexing is the next evolution in the investing landscape. Originally referred to as “the Great Unwrapping“, Direct Indexing should no longer just be thought of as a technology that gives investors the ability to invest directly into indices without going through the ETF structure but is also the technology that allows investors to dynamically navigate the ETP landscape in a way that would have been unwieldy and/or cost-prohibitive historically.

Consider the following 2 examples of direct indexing, which not only highlight the benefits for the investor, but also demonstrates the added value an Advisor can provide it clients:

Tax Optimization: An advisor has several clients (ranging in account size from $1M to $100M) each of whom is invested in a slightly different Large Cap Value index tailored specifically to suit them. For instance, one client has an ESG filter while another has a cap on Utilities. Each client’s exposure, in addition to being customized, is also rebalanced according to how it fits within the rest of their portfolio and tax-loss harvested in order to maximize performance based on their specific situation.

Risk-Management: An advisor uses a “Turnkey Asset Management Platform” (TAMP) to run models for his clients. Because of the environment and expectations going forward, the advisor wants to begin allocating to diversified commodities exposures but does not want to use a passive, long-only ETP. As a result, the advisor selects a third party manager that specializes in providing tactical exposures across the Barclays iPath commodity ETNs. For the advisor, it’s as simple as “allocating” to this model which, because of the direct indexing technology provided by the TAMP, is now virtually indistinguishable from allocating to an ETF….except this one is actively managed.

Using Direct Indexing to Navigate the “New Normal” Going Forward

The world changed for everyone after the Covid pandemic of 2020. Markets changed as well. With the advent of record levels of inflation and the subsequent response from the Federal Reserve, investors now find themselves in a much trickier environment going forward. The end of the “Fed Put” means that investors can no longer use the simple 60/40 portfolio (or derivations thereof) as a “set it and forget it” option. As a result, it should come as no surprise that there’s been a meaningful uptick in interest in direct indexing and the utility it can provide in uncertain times.

The value of direct indexing is no strictly relegated to tax optimization (as it has been historically)…now, with the increased availability (and sophistication) of “Turnkey Asset Management Platforms” (“TAMPs”), advisors can much more easily and efficiently allocate to sophisticated alternative exposures that:

(i) using only liquid instruments such as equities and ETPs.

(ii) are specifically designed to navigate the risks of the current environment.

(iii) can be customized for advisors in a way that existing ETPs can’t.

As an example, a tactical strategy that dynamically rotates among commodities-focused ETPs based on an evidence-based ruleset (such as momentum) can provide advisors with a very effective and cost-efficient allocation to an asset class that (i) looks more important going forward in a “stag-flationary” type environment and (ii) is subject to larger bouts of volatility that would necessitate a risk-managed approach.

Conclusion

If direct indexing was a “nice to have” option for investors a couple of years ago, it’s now looking more like a requisite tool in investors’ toolkit. The combination of low forward looking expectations for traditional asset classes coupled with higher likelihood of continued volatility means advisors now don’t have the luxury of relying on a simple 60/40 allocation with an occasional “but the dip”.

We anticipate history will look back on the post-covid era as the catalyst that propelled direct indexing as the new standard for advisors going forward…and investors will be the better off for it.

[1] https://www.ft.com/content/6dabad28-e19c-11e6-9645-c9357a75844a

[2] http://jii.iijournals.com/content/5/3/73

[3] https://www.ft.com/content/6dabad28-e19c-11e6-9645-c9357a75844a

[4] http://www.etf.com/sections/features-and-news/cost-run-etf?nopaging=1

[5] http://www.businessinsider.com/deutsche-bank-rise-of-etf-financial-crisis-2017-9?r=UK&IR=T

[6] https://www.marketwatch.com/story/bofa-warns-the-rise-of-etfs-is-distorting-the-stock-market-2017-07-05

[7] https://www.federalreserve.gov/newsevents/speech/fischer20161115a.htm

[8] http://www.investmentnews.com/article/20160710/FREE/307109998/etf-liquidity-a-growing-point-of-financial-industry-contention

[9] https://www.blackrock.com/corporate/literature/whitepaper/viewpoint-us-equity-market-structure-october-2015.pdf

[10] https://www.ifa.com/articles/quantifying_value_loss_harvesting

[11] http://www.wealthmanagement.com/etfs/build-your-own-index