Options Watch: Fixed Income ETF Edition

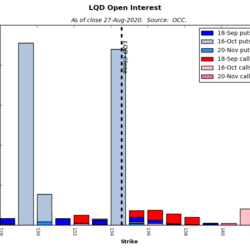

We’ve written before about how options positions in the SPY ETF drove price action on a quiet summer Friday afternoon. A recent trade in options on a fixed-income ETF bears watching, as it may influence the price of the ETF in the coming weeks. The ETF in question is LQD, the $56 billion portfolio of Read more about Options Watch: Fixed Income ETF Edition[…]