Occasionally, we can get a glimpse into exactly what is driving market prices over a particular period of time. This can be instructive for understanding certain market dynamics and how they might relate to future price moves.

For the afternoon of July 24th, 2020 we believe we have a clear explanation for the price moves in the SPY ETF. To us, the moves appear to clearly be driven by positions in options contracts.

Below is the intraday price chart for SPY, from noon (ET) through the 4PM close. These moves may not seem large, but there is quite a tug-of-war going on underneath the surface.

Early Friday afternoon, SPY was trading around 320.50. A move to 321 is rejected, as is a move to 320. Just after 1:00PM, we break through 320, push toward 319, but are pulled straight back to 320.

From 2PM through 3:15PM, we oscillate around 321, and then the real tug-of-war begins, as the SPY is drawn to 320, only to have it quickly rejected (again) as the session finishes with bouncy moves between 320.50 and 321.

What drove this?

We think options positions are the culprit.

For 24th July expiry, there were over 58,000 contracts of open interest at the 320 strike in SPY. Compared to other nearby strikes, this sticks out:

All of these options contracts expire at 4:15PM. At that time, their exposure becomes binary–they turn into shares of SPY, or they turn into nothing. If SPY is trading at 319.95, the 320-strike calls are worthless, and provide no exposure to SPY. Similarly, if the SPY is trading at 320.05, the 320-strike calls are exercised, and provide 100% exposure to SPY.

Options dealers typically don’t want to carry exposure to the direction of the underlying. Their business, after all, is to trade options. So they hedge the market exposure, buying and selling shares of SPY (and related instruments) to balance their books. As the price of SPY changes, their exposure changes; away from expiry date, these movemenst in exposure tend to be reasonably gentle.

But, as we approach expiry, the exposure generated by options (especially those with strike prices close to the current price of SPY) changes much more quickly. As SPY moves through an options strike, dealers need to rehedge.

How big is this Rehedging?

We don’t know, exactly, since we don’t know everyone’s position. But we can make a reasonable estimate. Using 58,000 contracts of open interest, 100 shares per contract, and a $320 share price for SPY, that is a market exposure change of over $1.8bn as we trade through the 320 strike. That’s the equivalent of over 11,000 e-mini S&P futures contracts. That market is deep and liquid, but that type of size will push things.

And that’s exactly what we see in the price action. SPY breaks through a strike, and is pushed back the other way as the hedges are executed. The effect is akin to a magnet: the market is pulled to the spot where we have the highest concentration of strikes.

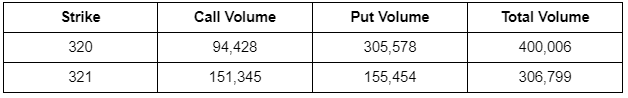

It’s also worth noting that there was heavy volume traded in the July 24th expiry options on expiry day:

These volumes are large: they are multiples of the prior outstanding open interest. This day-of-expiry trading activity likely added to the magnet effect. With all of the necessary exposure hedging around these strikes, SPY finished the day stuck between 320 and 321.

It’s a summer Friday afternoon. Asia is closed, London is closed, and there’s no newsflow. We’re left with one explanation for price movements: options expirations. With the increase in options volumes–especially from retail accounts–these types of late-day magnetic pulls may become a permanent feature in markets.