We’ve written before about how options positions in the SPY ETF drove price action on a quiet summer Friday afternoon. A recent trade in options on a fixed-income ETF bears watching, as it may influence the price of the ETF in the coming weeks.

The ETF in question is LQD, the $56 billion portfolio of U.S. dollar-denominated, investment grade corporate bonds. Its ticker, LQD, evokes–not by coincidence!–the word “liquid”, as this ETF is designed as an inexpensive, easy-to-trade access product to a longer-maturity investment-grade corporate bond portfolio. Indeed, it’s succeeded in that regard: over the past year, LQD trades approximately 13 million shares per day on average, which is equivalent to approximately $1.7 billion in market value. It’s a useful tool for individual accounts and smaller institutions alike.

As for many other equities, options contracts are available on LQD. This part of the options market is pretty sleepy, though. LQD, underpinned by its high-grade corporate bond holdings, isn’t the most volatile stock, and options volumes are generally pretty listless.

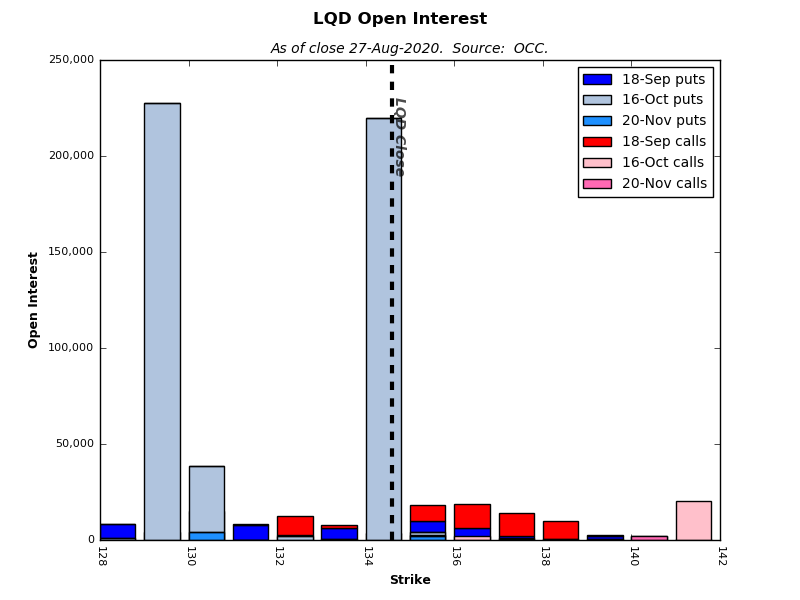

This past week, however, something jumped out at us. Every day, the Options Clearing Corporation (OCC) publishes its open interest statistics–these tell us, by strike and expiry date, how many options contracts are outstanding. We watch these (and other) reports to get a sense for market flows and positioning. From our monitors, we saw that a huge trade went through in options on LQD. This activity sticks out clearly on the graph below, which shows open interest in LQD options contracts.

Whoa! In a market where five or ten thousand contracts is a large position, someone traded approximately two hundred twenty thousand puts for expiry 16th October 2020, at each of the 129 and 134 strikes.

Why does this matter? These are large trades not only in the context of the options market, but–more importantly–these are large trades in the context of the trading activity of the underlying fund! Each options contract controls one hundred shares, so if these options are in-the-money come expiry day, over twenty-two million shares of LQD will be deliverable in the contracts. That’s 1.7 times the recent average daily trading volume. LQD is liquid–but it’s not that liquid!

If LQD’s price is far-enough away from 134 and 129 as we approach mid-October, this options position shouldn’t have a large impact on the price of LQD. However, if we’re close to 134 or 129, LQD may see a flurry of trading activity as options holders hedge their positions. Dale Rosenthal characterizes this potential activity in his 2018 book as “pin risk”, or “the unusually-high probability of options to expire at [their] strike price”. He states that the price impact of the most-active hedgers, if they are owners of the contracts, will tend to push the underlying towards the strike. Similarly, if the most-active hedgers have shorted these contracts, their activity will tend to push the underlying away from the strike.

Our guess here is that the most-active hedgers sold the 134-strike contracts and bought the 129-strike contracts. As we approach expiry, we’d expect LQD’s price action to be volatile around 134, and muted around 129.

These options contracts affect a large number of LQD shares, to be sure, but LQD’s size still pales in comparison to the entire corporate bond market. Its index, the iBoxx USD Liquid Investment Grade Index, covers a market value north of $1 trillion, making LQD just a small portfolio of the outstanding market size. Options on 22 million shares of LQD translates to roughly $3 billion in corporate bonds–a mere speck in the context of its index. Furthermore, ETFs have share-creation and -redemption features that market makers can use to manage their inventories and provide the liquidity they need to meet the requirements of options deliveries.

This big options trade may be nothing more than a fun cocktail-party fact. But we’ll be watching LQD, and these contracts. If the options are still open, and LQD is close to the strike prices, expect to see an effect around October 16th.

Reference: Rosenthal, Dale W.R., “A Quantitative Primer on Investments with R”, Chicago: Q36 LLC, 2018. www.q36llc.com/think. This is a great reference on a number of finance topics, taken through a quantitative lens, with numerous programming examples and exercises.