Tax Optimized Direct Indexing

Tax Optimization is one of the biggest advantages to Direct Indexing and can be more powerful than many investors realize. Beyond just “Tax Loss Harvesting”, a comprehensive tax-optimization plan, can add meaningful, after-tax alpha, to a portfolio even when stock dispersion is relatively low and markets are increasing.

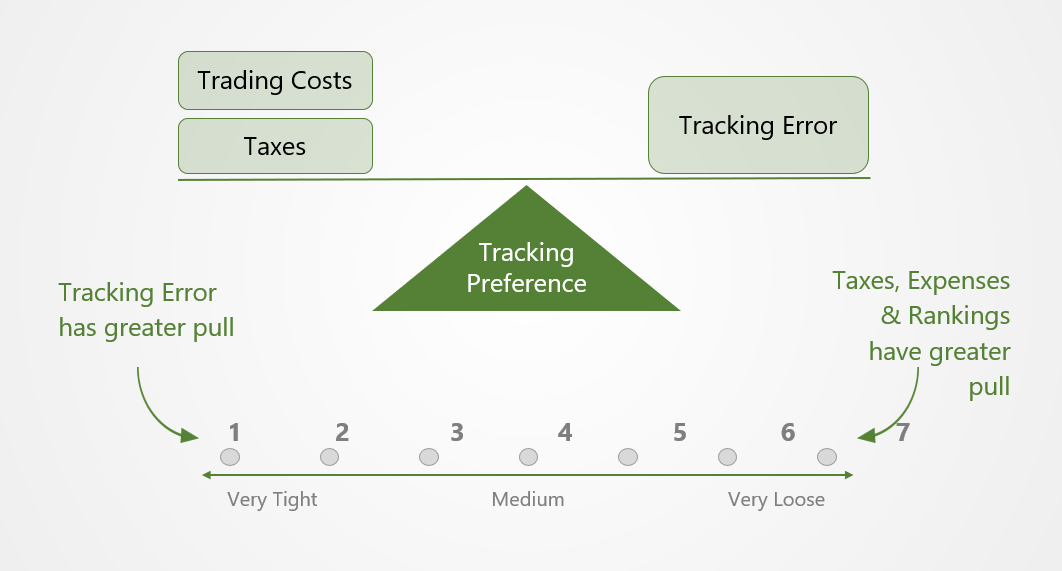

As with other elements of Direct Indexing, client customization is a key component. There is no such thing as a “tax optimized” version of an index; rather, there is a menu of choices available to the investor depending on their appetite for tracking error vs. potential tax alpha.

The Benefits

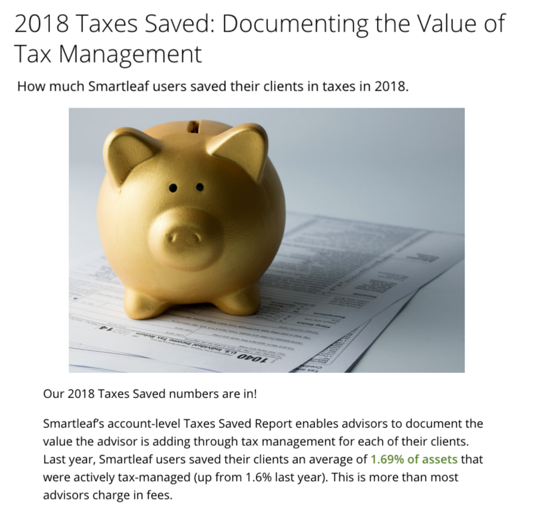

While the benefits to a tax-optimization strategy are highly variable depending on client preferences, the portfolio or index being optimized and the market environment….the empirical data is very encouraging.

In fact, the 2018 numbers from SmartLeaf, one of the leading tax-optimization providers, showed that, on average, their clients earned 1.69% tax alpha that year.

Example:

IDX LargeCap Multifactor Defensive

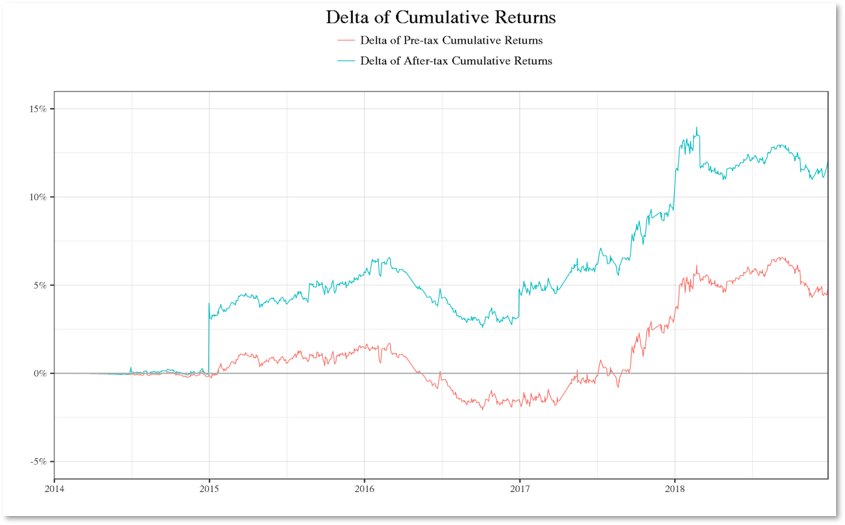

As part of an analysis for a client, IDX Insights worked with SmartLeaf to estimate the potential tax-alpha that could have been available to an account that would have been invested in the IDX LargeCap Multifactor Defensive Index. This assumes the account started in cash in 2015 and was fully invested in the IDX index. No management fees or transaction costs were assumed.

The graph below shows the hypothetical cumulative growth charts (from 2014 to 2018) for the original Index (in red) as well as the estimated after-tax index (in turquoise). The tax-managed version of the index, before taxes, is shown in green and the after-tax version of the tax-managed index (in purple):

Part of the analysis is understanding how the tax-optimization decisions (to buy and sell stocks) impact the tracking error to the underlying index (in which no such trades are made). Again, this is ultimately a function of investor preferences and appetite for tracking error to the original index. The cumulative delta of the tax-managed version of the IDX LargeCap Defensive Index is shown below. Note, because this portfolio began as cash, there was an immediate tax-benefit that accrued in the first year (approximately 4%). However, even after taking that into account, the subsequent hypothetical tax-alpha accrued to over 10% over this 5 year period:

Isolating the tax alpha over time is shown below:

While these results are hypothetical (so standard caveats apply), one of the interesting results to note is that the IDX LargeCap Multifactor defensive Index generally has a lower-volatility profile and lower stock dispersion. Intuitively, this wouldn’t necessarily seem like a rich opportunity set for tax optimization, particularly over a period in which the markets were trending up. However, as seen above, tax management matters and the opportunity is not one that can be ignored.

Information is presented for illustrative purposes only. IDX Insights makes no guarantees regarding accuracy or completeness. Unless otherwise noted, performance information is hypothetical and GROSS of all associated fees and sales and trading expenses that an investor might incur. You cannot invest directly in an index. Hypothetical or model performance results have certain limitations including, but not limited to: hypothetical results do not take into account actual trading and market factors (such as liquidity disruptions, etc.). Simulated performance assumes frictionless transaction costs and no lag between signal generation and implementation. Simulated performance is designed with the benefit of hindsight and there can be no assurance that the strategy presented would have been able to achieve the results shown. There are frequently large differences between hypothetical performance results and actual results from any investment strategy. While data was obtained from sources believed to be reliable, IDX Insights, LLC (“IDX”) and its affiliates provide no assurances as to its accuracy or completeness.