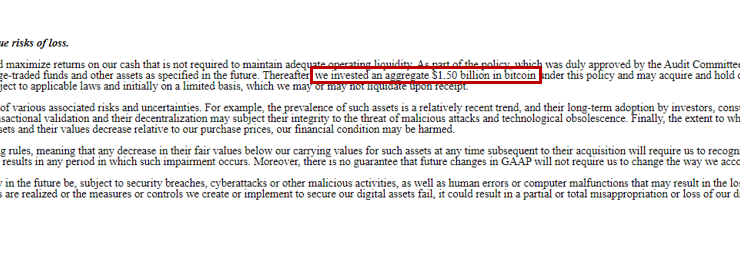

On Monday, February 8th, Tesla announced in an SEC filing that it had purchased $1.5 Billion (yes, with a “B”) in bitcoin:

Fans and/or followers of Elon know he’s been something of a proponent of bitcoin (and DOGE coin too apparently) for some time…but the magnitude of the purchase, coupled with the announcement that Tesla intended to start accepting Bitcoin as payment, still surprised many.

Separately, the Gamestop debacle has thrust Reddit onto the stage as a force to be reckoned with on Wall St. As proponents and practitioners of “big data”, we have been monitoring social chatter on reddit long before r/WallStreetBets became a household name and we have consistently seen value in the conversations on various subs.

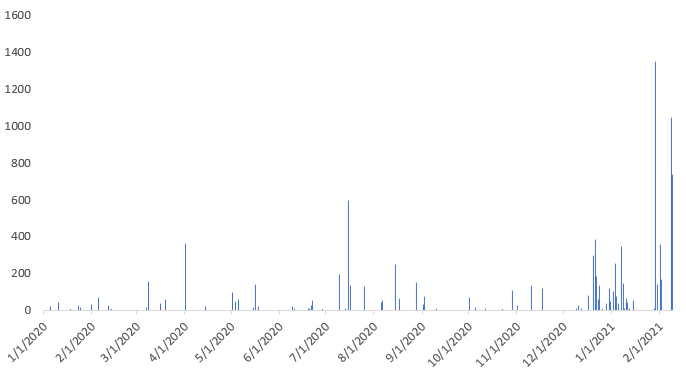

In particular, after the Tesla revelation, we went back to our database to see what the data said as it relates to conversations around Elon Musk and Tesla. Specifically , we pulled data from the r/bitcoin subreddit and focused only on those posts which had the words “Telsa”, “Elon” or “Musk” in the title and had received at least one reaction or comment:

As you can see, Elon Musk and/or Tesla has been a fairly persistent topic among redditors in the r/bitcoin sub…but it really seemed to pick up in 2021.

As a next step we look at the most common OTHER words in these titles over this period:

The usual suspects show up: ‘buy‘, ‘invest‘….but there are some other interesting words such as ‘acceptance’ and, of course ‘tweet‘ and ‘twitter‘. Remember, these are the most common words showing up WITH ‘Elon‘, ‘Musk‘ and/or ‘Tesla‘.

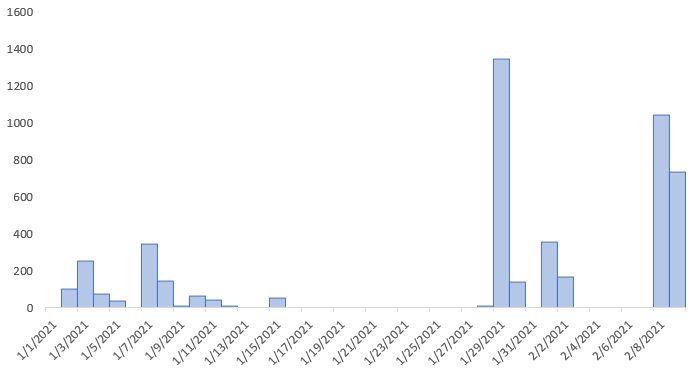

If we zoom in on 2021:

Right away we can see that there are three distinct periods of activity.

There was some early chatter in the beginning of the year and then again more towards the end of January and more recently this week.

Let’s focus on the first 15 days of January first and see what the common word pairs are:

…’mining‘ and ‘wallet‘ are featured a little more often and ‘coinbase’ is an interesting addition relative to our first distribution.

Now lets look at the next period of activity from Jan 27th to Feb 2nd. The first thing to note (on the chart above) is the sheer magnitude of posts from this period. That clearly signals a higher degree of “importance” or “conviction” to the word distribution shown below:

Now we see some interesting developments…namely that ‘twitter‘ and ‘bio‘ feature very prominently (which is consistent with Musk updating his twitter bio with the bitcoin emoticon). Combined with the fact these words showed up in a LOT of conversations and we can clearly see that this event (Elon Musk updating his twitter bio with bitcoin) was seen as big news.

Similarly, we see ‘robinhood‘, ‘hedge‘, ‘gamestop‘, ‘gme‘ as well as ‘doge‘ and ‘dogecoin’ which reflect the fact that redditors were using GME to wage war on hedge funds as well as the fact that Elon Musk went on Clubhouse and confronted the Robinhood CEO.

In drilling further into this period of activity (between Jan 27th and Feb 2nd), we find a few very interesting posts:

This one from Sunday, Jan 31st:

Then, this one from Monday, Feb 1st:

…and finally, this one from Tuesday, Feb 2nd:

And then when we fast forward to final period of activity which came after news of the $1.5BN purchase broke, we see ‘billion‘, ‘bought‘ and ‘investment‘ pop to the top:

The Takeaway

Conversations on social media (in general) and reddit (in particular), provide an interesting dataset with which one can quickly get a sense of:

(i) the prevailing themes that are being discussed and

(ii) the relative importance (or intensity) around those themes.

As it relates to conversations about Tesla and/or Elon Musk, this allowed us to quickly identify the period at the end of January as being uniquely intense around Elon Musk’s (apparent) endorsement of bitcoin by putting it in his twitter bio. That is clearly a signal, in and of itself, but further uncovering specific posts that hinted at the news that would break a week later is equally interesting.

One of the biggest appeals of “big data” in the social ecosystem is the fact that the possibility of uncovering not just larger social sentiments (and changes in) but also being able to rely on an embedded curation function that all social environments foster.

In this case, the idea of Tesla buying bitcoin wasn’t new…in fact, it had been already (apparently) considered by none other than Elon Musk himself:

The social reaction to Elon updating his twitter bio was clearly larger than the “typical” chatter around bitcoin and Tesla (as our data showed). Also, we also how the “wisdom of the crowd” also helped a potentially higher probability around an outcome (Tesla buying bitcoin). The “crowd” is generally very helping turn up useful nuggets of information among a sea of data. This instance was no different.