originally published by Palladiem

Current Investment Strategy and Themes

- Markets rallied, but the economic fundamentals will be the worst investors ever experienced.

- Portfolios should reflect economic transition, but avoid low quality and high leverage.

A Mid‐Quarter Review of the Markets

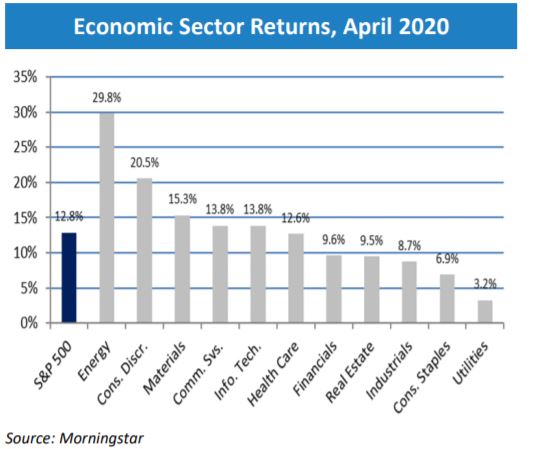

The two key dates for investors in 2020 are February 19th and March 23rd. The February date is the S&P 500 high point of 3386.15. March 23rd is the low point to date of the S&P 500 0f 2237.40. The unanswered question is whether March 23rd is the very bottom of the bear market, or the recovery since March 23rd is just a bear market rally that will ultimately test and descend through that March 23rd value. In a little over four weeks, stock prices plunged ‐33.9%. From that low, by April 29th, the market recovered 31.4%. For the S&P 500 to reach the old high value, it needs to recover 51.3%.

There is very little certainty on how and when the economy recovers. The only certainty is that the economy going forward will not be the same economy that entered this crisis. Economies are always composed of a series of secular and cyclical changes across each sector. The secular changes across industries will be accelerated, both positive and negative. No doubt technology and innovation will drive the changes to the future economy. Economic crisis are often the cause of, or the result of political or social upheaval. Just as we expect the economy will look very different as we move through this decade, we expect the geopolitical landscape to end this decade looking nothing like how we entered it here in 2020.

The March 23rd date is very important for the signaling that occurred in the market and took the downward pressure off financial assets. The Federal Reserve announced on that day they would be a buyer of corporate bonds and ETF. Just the announcement that they would buy risk‐based assets reopened collapsing markets. Asset purchases and a negative interest rate policy are two tools that the Fed can use to stimulate the economy. The medium and long‐term effectiveness of a both means are unproven in restoring GDP to normal levels.

Our Views on Markets and Portfolios

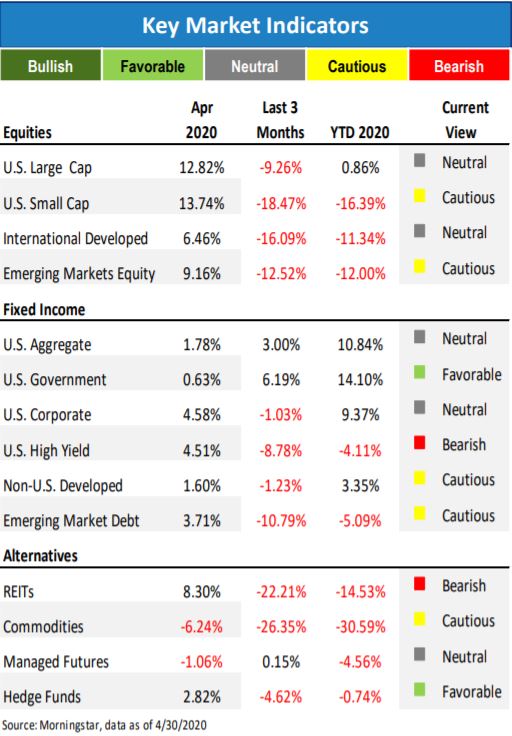

The economy is in transition. Equities should reflect that change. Investors typically prefer to balance the risk of uncertain growth with the safety of income. The risk of reaching for income remains one of the greatest risks investors face. Dividend and leveraged income strategies require more diligence and caution.

Important Disclosures

The statements contained herein are based upon the opinions of Palladiem LLC (Palladiem) and the data available at the

time of publication and are subject to change at any time without notice. This communication does not constitute

investment advice and is for informational purposes only, is not intended to meet the objectives or suitability

requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any

model will be met. An investor should assess his/her own investment needs based on his/her own financial circumstances

and investment objectives. Neither the information nor any opinions expressed herein should be construed as a

solicitation or a recommendation by Palladiem or its affiliates to buy or sell any securities or investments or hire any

specific manager.

Palladiem prepared this Update utilizing information from a variety of sources that it believes to be reliable that may

include, but not be limited to, custodians, mutual fund companies, investment managers, Morningstar, Bloomberg, other

third‐party service providers and in some cases as directed by the client or their representative. Palladiem takes

reasonable care to ensure the accuracy of such information but does not warrant that it is complete, accurate or adequate

and it should not be relied upon as such.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any

investment, asset class, style or index will provide positive performance over time. Diversification and strategic asset

allocation do not guarantee a profit or protect against a loss in a declining markets. Past performance is not a guarantee of

future results. All investments are subject to risk, including the loss of principal. Portfolio positions referenced are subject

to change at any time, your portfolio may not reflect the information referenced.

Palladiem has sole discretion to change allocations to styles and vehicles at any time.

Index definitions:

“U.S. Large Cap” represented by the S&P 500 Index.

“U.S. Small Cap” represented by the Russell 2000 Index.

“International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index.

“Emerging” represented by the MSCI Emerging Markets Net Return Index.

“U.S. Aggregate” represented by the Bloomberg Barclays U.S. Aggregate Bond Index.

“U.S. Government” represented by the Bloomberg Barclays U.S. Government Bond Index.

“U.S. Corporate” represented by the Bloomberg Barclays U.S. Credit Bond Index.

“U.S. High Yield” represented by the Bloomberg Barclays U.S. Corporate High Yield Index.

“Non‐U.S. Developed” represented by the S&P International Treasury ex U.S. Index.

“Emerging Market Debt” represented by the JP Morgan GBI‐EM Global Core Index

“REITs” represented by the FTSE North American Real Estate Investment Trust (REIT) Equity REITs Index.

“Commodities” represented by the Dow Jones Commodity Index .

“Managed Futures” represented by the Credit Suisse Managed Futures Index.

“Global Macro” represented by the Credit Suisse Global Macro Index

Palladiem, LLC is a Registered Investment Adviser.

For more information about Palladiem, as well as its products, fees and services, please refer to Palladiem’s website,

www.palladiem.com or call us at 888‐886‐4122; 610‐304‐6529