Using Quantitative Finance to Regulate Exposure to Cryptoassets

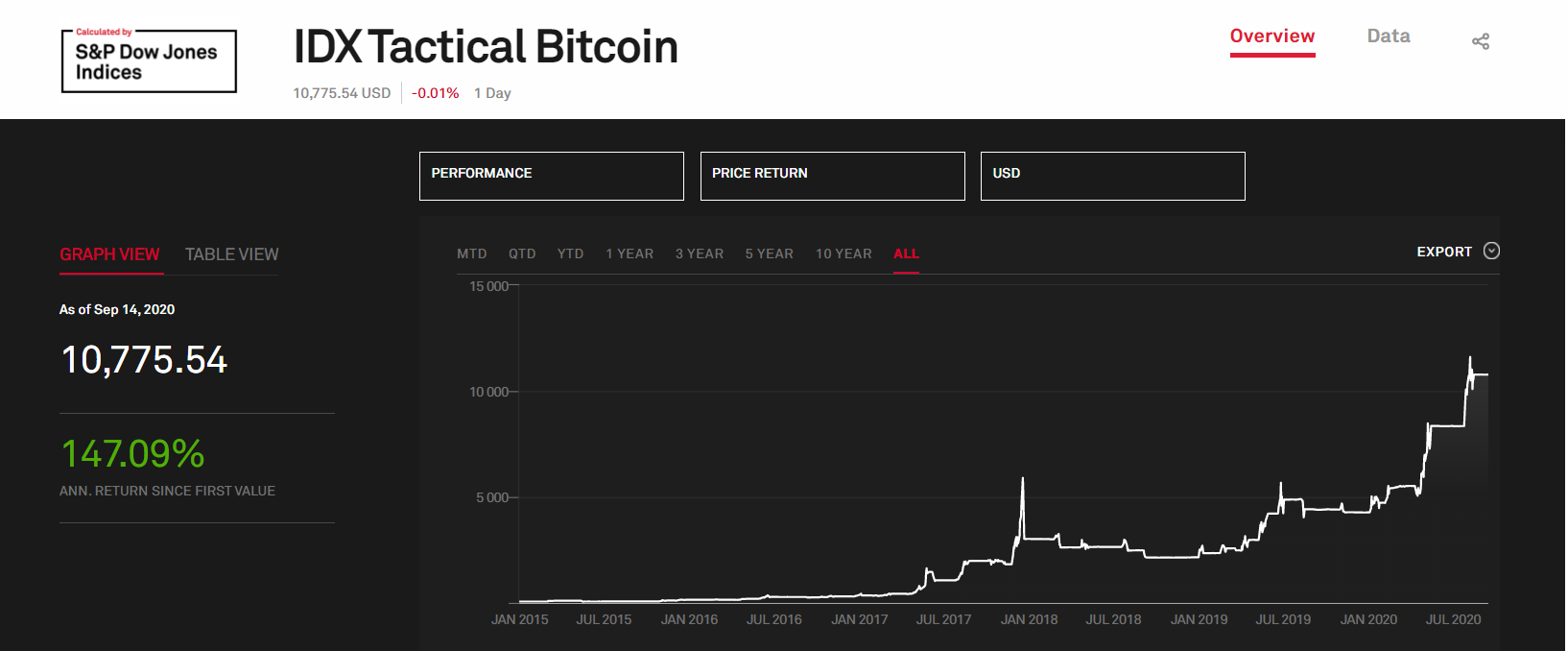

The IDX Crypto Opportunity Index (COIN) seeks to provide tactical upside participation to bitcoin via the Grayscale Bitcoin Trust (GBTC) while seeking to limit drawdowns and downside volatility. The data shown below is from the IDX Tactical Bitcoin Index as calculated by S&P.

The COIN methodology tactically manages exposure to Bitcoin. The goal being attractive risk-adjusted returns relative to a long-only position in Bitcoin over time. Price changes determine when short-term momentum is positive and accelerating. The objective of the COIN strategy is to opportunistically deploy risk capital to GBTC when the risk-return profile of bitcoin is favorable. Likewise, the strategy seeks to preserve capital when the risk/reward profile is unfavorable through an allocation to a diversified basket of fixed income ETFs.

Please see important performance disclosures at the bottom of the page.

The IDX Tactical Bitcoin Index is calculated by S&P Dow Jones Indices using signals from IDX applied to the Grayscale Bitcoin Trust (GBTC). There are specific risk factors associated with GBTC including but not limited to (i) the potential for very large tracking error to bitcoin (due to limited trading hours, limited liquidity and frequent premiums or discounts to NAV). Furthermore the performance in the index is hypothetical and therefore carries further disclaimers.

Hypothetical or model performance results have certain limitations including, but not limited to: hypothetical results do not take into account actual trading and market factors (such as liquidity disruptions, etc.). Simulated performance assumes frictionless transaction costs and no lag between signal generation and implementation. Simulated performance is designed with the benefit of hindsight and there can be no assurance that the strategy presented would have been able to achieve the results shown. There are frequently large differences between hypothetical performance results and actual results from any investment strategy. While data was obtained from sources believed to be reliable, IDX Insights, LLC (“IDX”) and its affiliates provide no assurances as to its accuracy or completeness.

Available At:

Webex with Grayscale & IDX

Our CIO Ben McMillan was joined by Grayscale’s CEO Michael Sonnenshein to discuss digital assets and financial advisor adoption. The two discussed a flurry of topics, including a 2020 year in review, what we are seeing in the advisory world for digital assets, and how IDX approaches the asset class with risk mitigation in mind.

Webex with Fidelity Digital Assets Group

Check out out latest Webex with Fidelity’s Digital Assets Group where we discuss the institutionalization of crypto-assets, the problems with high volatility (and drawdowns) and how the IDX Crypto-Opportunities Index employs a unique, rules-based approach to try to provide meaningful upside participation in a risk-managed fashion.

“Interactive Brokers LLC is a registered Broker-Dealer, Futures Commission Merchant and Forex Dealer Member, regulated by the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), and is a member of the Financial Industry Regulatory Authority (FINRA) and several other self-regulatory organizations. Interactive Brokers does not endorse or recommend any introducing brokers, third-party financial advisors or hedge funds, including IDX Advisors LLC. Interactive Brokers provides execution and clearing services to customers. None of the information contained herein constitutes a recommendation, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Interactive Brokers makes no representation, and assumes no liability to the accuracy or completeness of the information provided on this website.

For more information regarding Interactive Brokers, please visit www.interactivebrokers.com. “

The Methodology

The objective of the COIN methodology is to provide risk-managed exposure to bitcoin. The index seeks to acquire long exposure to GBTC at those times when the risk/return profile is disproportionately skewed to the upside. It’s not enough that Bitcoin is simply “going up” …it must be going up at an increasing rate.

By design, this presents a relatively high bar for participating in Bitcoin. Similarly, a relatively low bar is set for taking risk OFF the table. As soon as either the price momentum of Bitcoin or the momentum of momentum of Bitcoin begins decreasing, the index allocates 100% to the IDX Tactical Fixed Income Index.

F.A.Q.

What Data is used to generate the signals?

Signals for COIN are generated using the price of Bitcoin (BTC) as provided by coinmarketcap.com (which is a weighted average price across multiple exchanges). You can read more about their methodology here.

Why are signals generated using Bitcoin instead of GBTC?

Generally, we want to incorporate as much data as possible when applying any quantitative method. BTC trades 24/7 as opposed to GBTC which trades only during market hours Monday through Friday. This allows for information from BTC price movements over the weekend to inform signal decisions on Monday. One risk of this implementation is an excessive delta between the behavior of BTC (which generates the signals) and GBTC (in which allocations are expressed).

Is GBTC an ETF? How does it trade?

GBTC is NOT an ETF. GBTC is a trust that that owns Bitcoin directly. Grayscale states that GBTC is modeled on popular commodity investment products like the SPDR Gold Trust. GBTC is traded publicly on the OTCQX, an over-the-counter market, under the Alternative Reporting Standard for companies not required to register with the Securities and Exchange Commission (SEC).

What happens when the signals “go to cash”?

The “risk off” portfolio (as we call it) is the IDX Tactical Fixed Income Index which is a diversified basket of fixed income ETFs. This index seeks to provide current income with superior risk-adjusted returns and lower duration relative to long-only fixed income benchmarks. The objective in using this as the “risk-off” allocation is that a yield can still be harvested while waiting for the GBTC allocation to go long.

When did the COIN model go live?

COIN went live on SMArtX on June 1, 2019. All returns prior to that date are hypothetical (and unless otherwise noted) GROSS of any fees or transaction costs.

Is this a better way to invest in Bitcoin?

Investing in Bitcoin carries inherent risks. Chief among these risks is volatility and the risk of losing money. We developed this index in order to try and provide exposure to bitcoin in a risk-managed fashion. Whether or not it’s a “better” way to access bitcoin depends on each investor’s risk-tolerance, objectives and suitability.

Can you provide daily data since the live date?

Yes, if you are a professional investor. Please contact us at info@idxinsights.com for more information.

Can you customize this Index?

Yes, depending on investor risk profile and objectives, the index can be tailored.

How can I invest?

The index is currently only available to RIAs via separate accounts and private placement trusts. Please contact bjacobson@idx-us.com for more information.