- The investment case for gold has gained more interest recently with the proliferation of negative rates, geopolitical uncertainty and an unprecedented increase in fiscal and monetary stimulus from global central banks.

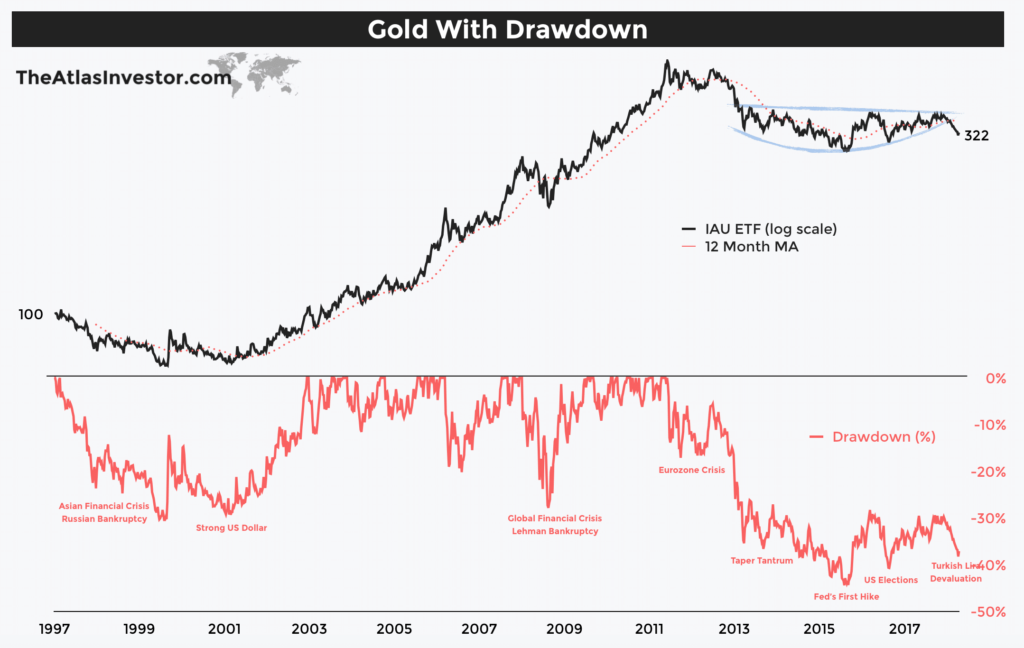

- Gold has a respectable long-term track record as an asset class but it is not with periods of high volatility and large drawdowns.

- We believe a systematic, tactical approach can offer investors a more risk-managed exposure to gold that can provide the same diversification benefits within a 60/40 portfolio but with lower volatility, lower drawdowns and a superior risk/return profile.

The Case for Gold

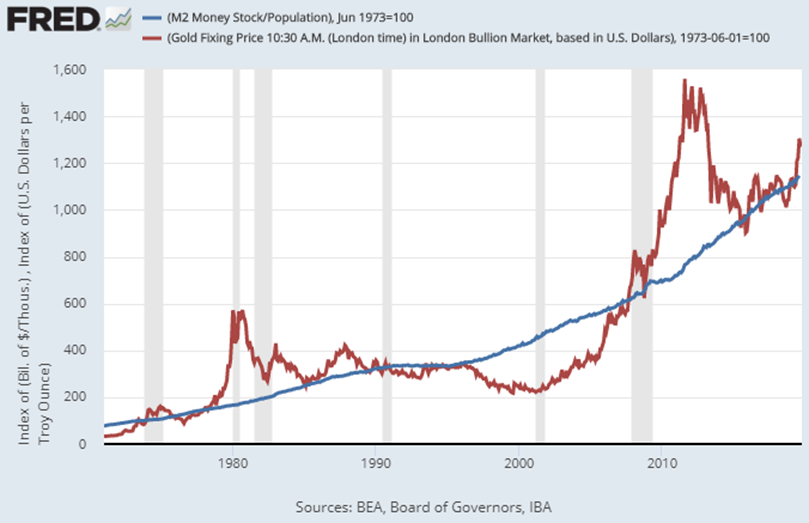

It’s no surprise that gold has traditionally been viewed by investors as a long-term store of value. During the inflationary periods of the 70’s, gold was a strong driver of returns during a period in which equities provided little relief:

“The Fed can’t print Gold.”

Traditional arguments against holding gold have been largely focused around (i) the cost of storage, (ii) the lack of a yield and (iii) the volatility. Amid a backdrop of negative interest rates, increased geo-political uncertainty and increased equity volatility, the case for gold has started to look more appealing to investors.

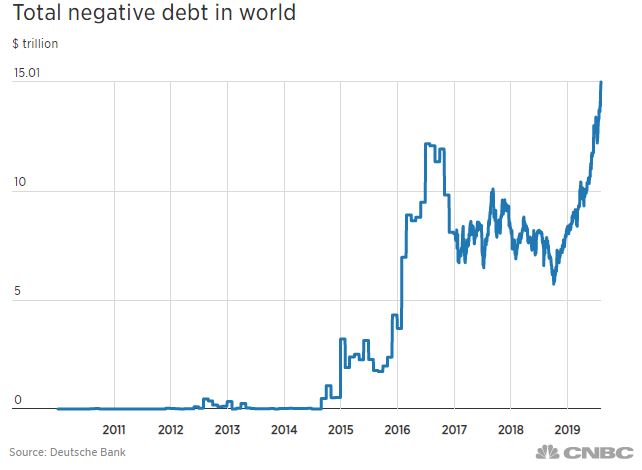

Particularly as investors are forced to reckon with trillions of dollars of negative debt, they’re now facing a reality in which an “asset” which used to generate a yield, now has cost. Now, the cost of storing bullion in a vault isn’t so bad when compared to bonds.

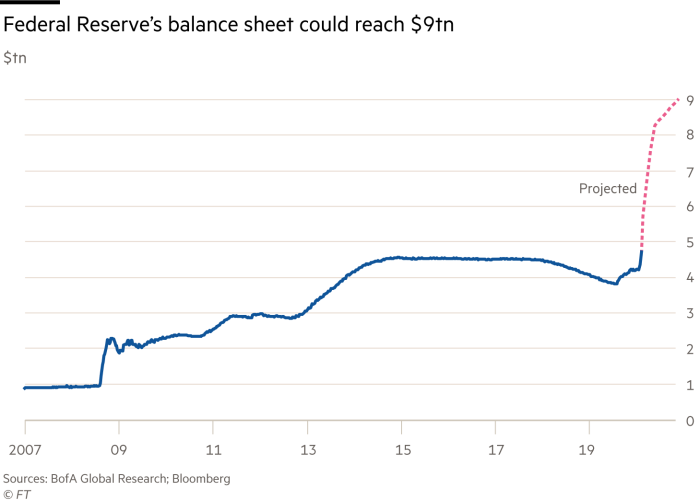

Similarly, with an unprecedented expansion of both the Fed’s balance sheet as well as the money supply, concerns over preserving value, regardless of inflation or deflation, are now moving to the top of investors’ minds:

Historically a Wild Ride

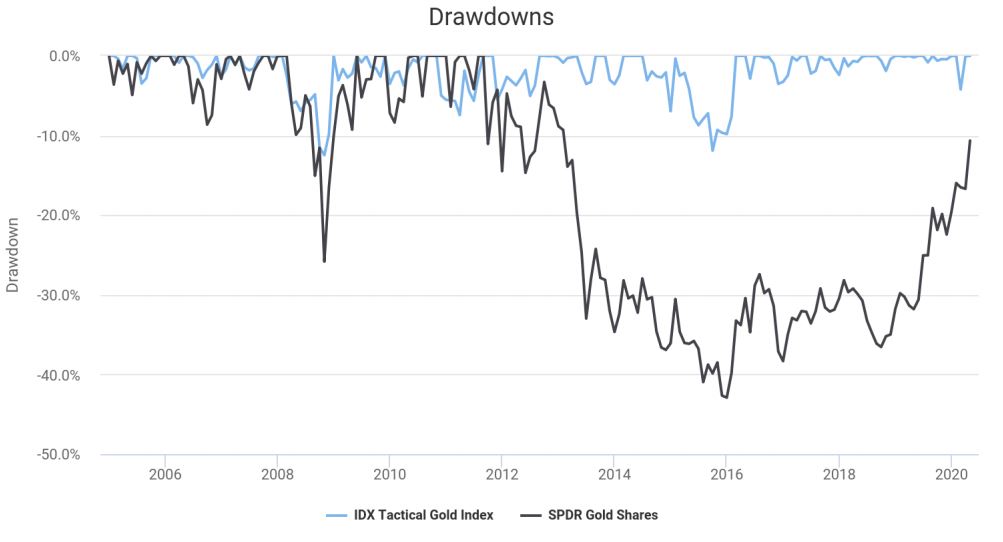

Even after setting aside concerns about the cost (or opportunity cost) of gold, the bigger issue (potentially) facing investors considering increased allocations to gold is the volatility and drawdowns that the yellow metal has endured historically:

We would argue that the volatility of gold, as an asset class, is the biggest risk factor facing prudent investors considering an allocation. For many, gold represents a new component within the portfolio, and while the forward looking case is clear, the prospect of excessive volatility and large drawdowns can quickly outweigh the benefits.

For that reason, a systematic and tactical methodology that opportunistically participates in gold, can be a tremendous way to gain exposure to the asset class in a risk-conscious way. The IDX Tactical Gold Index seeks to do exactly that.

Taking a “Smart Beta” Approach

Rather than mine the data for an optimal set of momentum parameters and rules, we opted to implement an established approach from the managed futures industry.

The goal: codify a robust process for attempting to signal asymmetric participation to bitcoin going forward not to optimize for what the best allocations would have been historically. In this case, momentum is evaluated over 4 different short-term timeframes and then weighted according to the length of the time-span.

The longer the span, the greater the weight (30 day lookbacks get more weight than 10 day lookbacks).

In order to signal a long allocation in the index, 2 conditions must be met:

(i) Momentum must be positive

AND

(ii) Momentum must be increasing

The objective: long exposure to those times when the risk/return profile is disproportionately skewed to the upside. It’s not enough that gold is simply “going up” …it must be going up at an increasing rate.

This presents a relatively high bar for participating in gold (by design). Similarly, a relatively low bar is set for taking risk OFF the table. As soon as either of these conditions is no longer met, the index allocates 100% to a diversified basket of fixed income ETFs (like the IDX Managed Duration Index).

The IDX Tactical Gold Index

By being very judicious with how capital is allocated to gold (in this case the SPDR Gold ETF (GLD)), the IDX Tactical Gold Index has historically only been long about 30% of the time, but has captured 100% of the total upside of Gold while only 29% of the downside:

Conclusion

As Gold continues to gain investor interest and participation, investors may be tempted to justify enduring the volatility associated long-only exposure as a “necessary evil”.

We firmly believe in rigorously evaluating and seeking out market risks that are compensated over time and the forces driving gold prices are no exception. We believe a rules-based, risk-focused framework (like the IDX Tactical Gold Index) that seeks to avoid uncompensated volatility in the gold markets represents a prudent method of participation for most investors over time.